All Categories

Featured

Table of Contents

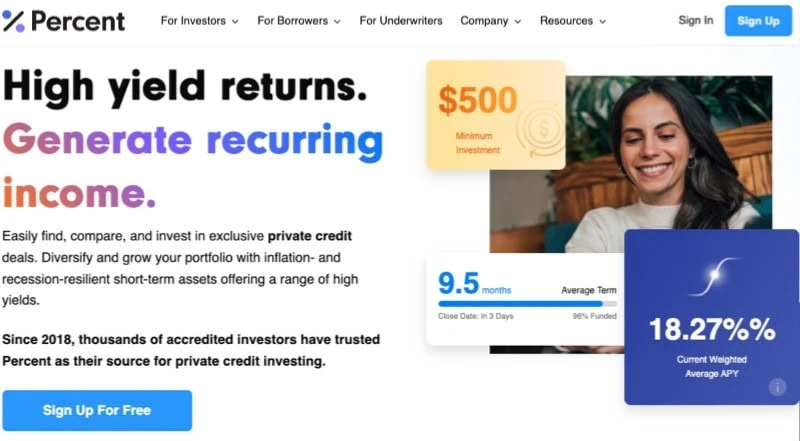

To make sure that accredited investors will certainly be able to create an extensive and diverse profile, we picked systems that can fulfill each liquidity demand from short-term to long-lasting holdings. There are various investment opportunities certified financiers can discover. Some are riskier than others, and it would depend on your risk cravings whether you would certainly go for it or not.

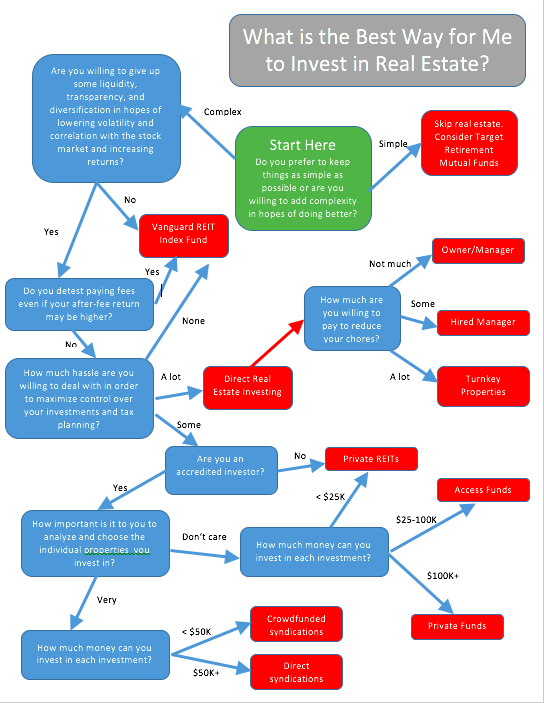

A genuine estate financial investment fund is one of the many means you can buy real estate. Realty financial investment choices like straight individual financial investment, genuine estate limited partnerships (LPs), realty investment company (REITs), and realty mutual fund have their advantages and disadvantages. Of all the options, a realty financial investment fund is often the very best one for those simply starting their actual estate investing trip.

Photo source: Getty Images. A genuine estate financial investment fund is a mixed resource of capital utilized to make real estate investments. (REITs); they're both pooled sources of capital used to invest in genuine estate.

These entities invest cash merged from financiers into a varied profile of real estate opportunities, including REITs, real-estate-related firms, and property buildings. Many property common funds are open to all capitalists as long as they meet the minimum financial investment demand. Capitalists can purchase most mutual funds via an economic expert, though some are readily available through on the internet broker agents.

How do I apply for Accredited Investor Real Estate Platforms?

They track a hidden index enabling financiers to make market-matching returns (minus expenses). Real estate ETFs are open to the public and profession on significant stock market exchanges., not the general spending public.

A few remarkable ones are: Diversification: The majority of realty investment funds provide investors broad direct exposure to the realty sector. They commonly possess lots of residential property types or invest in several different REITs. Diversity helps in reducing risk, although it can likewise decrease a capitalist's return capacity. Lower first financial investment limit: Most realty funds have fairly reduced preliminary financial investment thresholds (typically much less than $10,000 for a common fund and not much greater than $100 for the majority of property ETFs).

Passive investing: Realty allows financiers to create passive income as lessees pay rent, yet being a property owner calls for active monitoring. On the other hand, genuine estate funds are a lot a lot more hands-off financial investments given that others deal with the active administration of the residential properties. Genuine estate financiers have many excellent fund choices offered to them nowadays.

This actual estate shared fund has a minimal investment of $3,000 and charges a low expense ratio of 0.13%. The fund purchases a broad range of REITs, supplying financiers exposure to the entire property market. Vanguard also offers an ETF version, Lead Real Estate ETF (-0.03%), which provides investors the exact same wide REIT exposure and reduced cost ratio.

It additionally has a reduced expenditure ratio (0.09%) and share rate (around $40 in mid-2024).

What is the process for investing in Commercial Real Estate For Accredited Investors?

These funds likewise allow capitalists to passively get involved in realty investments, freeing up their time for various other things. Realty funds can be an optimal option for those just starting their property spending journey. Matt DiLallo has no placement in any one of the stocks pointed out. The has placements in and suggests Vanguard Real Estate ETF.

Numerous selections that accommodate varying threat accounts and spending preferences are offered on the finest investment systems for certified investors (Real Estate Investment Funds for Accredited Investors). It's crucial to understand which are best for accredited financiers in order to make use of special offers, branch out profiles, enhance returns, see brand-new fads, and get expert recommendations. If you are looking to invest as an expat or high-net-worth person, which is what I specialize in, you can email me () or WhatsApp (+44-7393-450-837)

Ultimately, the best systems depend on where you are based, your risk account and what you desire to achieve. Individuals or organizations that particular monetary requirements from regulators are what's thought about recognized capitalists.

We are a modern technology company that uses software and experience to bring lending institutions and borrowers with each other. We utilize cookies to give you with a great experience and to help our website run successfully.

Accredited Investor Real Estate Investment Groups

(SEC).

Recognized capitalists are able to spend cash directly into the financially rewarding globe of personal equity, personal placements, hedge funds, financial backing, and equity crowdfunding. Nonetheless, the demands of who can and that can not be a recognized investorand can take component in these opportunitiesare established by the SEC. There is an usual misconception that a "process" exists for a private to end up being a recognized investor.

The problem of proving a person is a certified financier falls on the investment car rather than the capitalist. Pros of being an approved capitalist include accessibility to unique and restricted financial investments, high returns, and raised diversity. Cons of being a certified investor consist of high risk, high minimal investment quantities, high fees, and illiquidity of the financial investments.

How can Accredited Investor Property Portfolios diversify my portfolio?

D) supplies the meaning for an accredited investor. Simply placed, the SEC specifies an accredited capitalist via the boundaries of income and net worth in two means: An all-natural person with income exceeding $200,000 in each of the 2 most current years or joint earnings with a partner exceeding $300,000 for those years and a reasonable assumption of the exact same revenue degree in the current year.

Roughly 14.8% of American Houses certified as Accredited Investors, and those homes managed about $109.5 trillion in riches in 2023. Gauged by the SCF, that was around 78.7% of all exclusive wealth in America. Regulation 501 also has provisions for firms, partnerships, philanthropic organizations, and rely on enhancement to company supervisors, equity proprietors, and monetary institutions.

People who base their credentials on annual earnings will likely require to submit tax obligation returns, W-2 forms, and various other records that show salaries. Certified capitalist designations also exist in various other countries and have comparable needs.

People who base their certifications on annual revenue will likely need to submit tax obligation returns, W-2 kinds, and various other records that show earnings. Recognized investor classifications additionally exist in other countries and have comparable needs.

Individuals that base their certifications on yearly revenue will likely need to send income tax return, W-2 types, and various other documents that suggest incomes. People may also take into consideration letters from evaluations by CPAs, tax obligation lawyers, financial investment brokers, or consultants. Approved capitalist designations also exist in various other nations and have similar needs.

Latest Posts

Tax Lien Home

Tax Defaulted Property For Sale

Tax Sale Foreclosure Properties